I’ve gotten behind on things as July and August have been busy months so this post is over a month late. The good news is that our income was booming in July (partly due to it being a 3 pay check month for me, and mostly because of Lady Kit’s dual employment as she changed jobs).

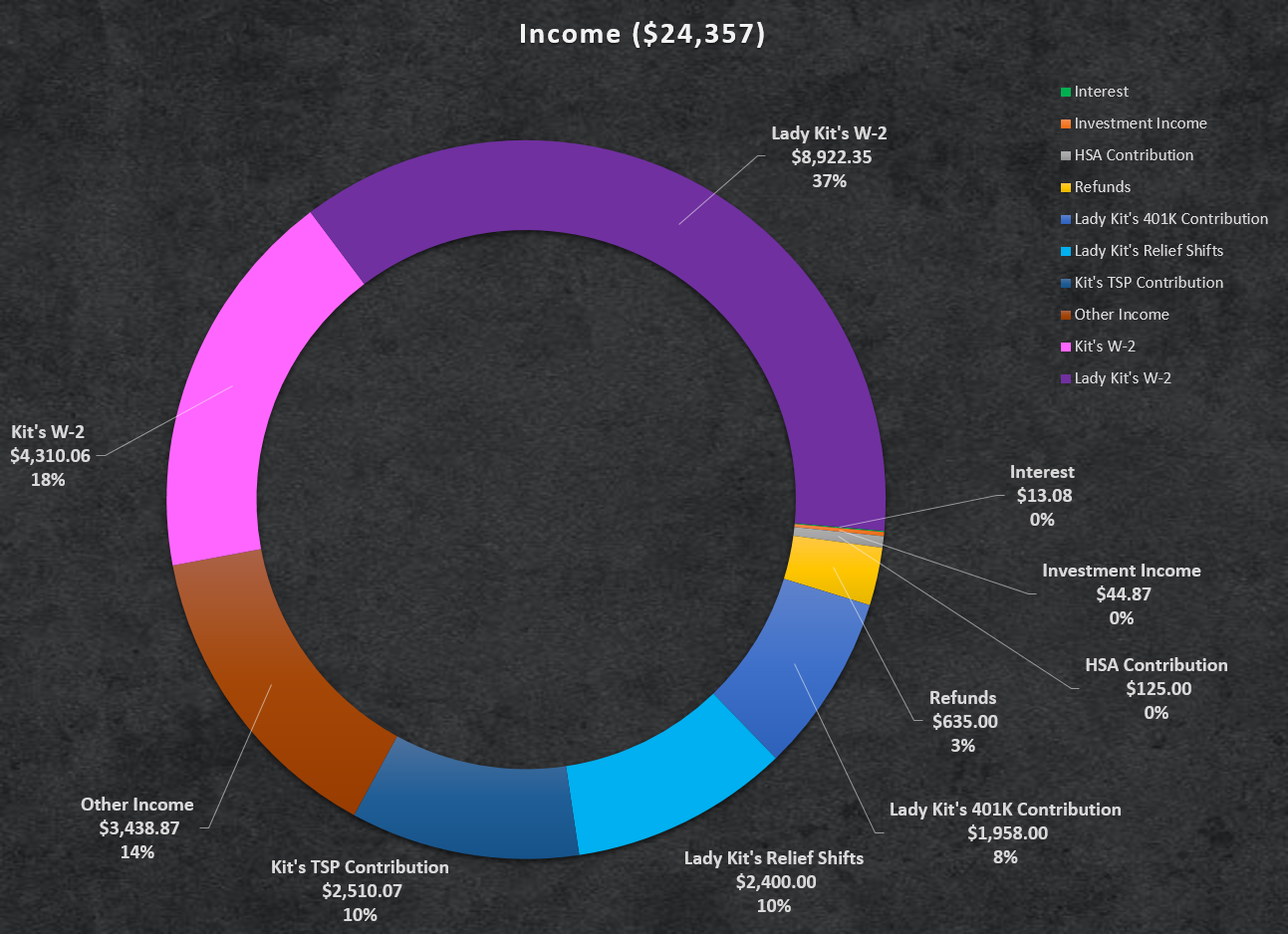

Income

As I mentioned our income did really well this month. We brought in a net $24,357. This includes our TSP and 401k contributions. As is now the standard Lady Kit provides the bulk of this income. We also had a one time extra deposit in the form a kickback from using the realtor referred to us by Navy Federal. As mentioned above this was also a 3 paycheck month for me as I get paid biweekly.

As I mentioned our income did really well this month. We brought in a net $24,357. This includes our TSP and 401k contributions. As is now the standard Lady Kit provides the bulk of this income. We also had a one time extra deposit in the form a kickback from using the realtor referred to us by Navy Federal. As mentioned above this was also a 3 paycheck month for me as I get paid biweekly.

Expenses (Even with out rent we blew through my goals)

Going into July I was hoping to finally meet a spending goal of $5,000 or less. I figured this should be the easiest month to do this as we pay our July rent in June (and counted it there), and our first mortgage payment wasn’t due until September. Unfortunately, moving got complicated quickly! We had a successful move out experience in January when we sold our house. We had a POD delivered my friend and his family came over and helped me pack it up and then PODS took the container away. This works great if you are moving from and to a suburban type neighborhood. Unfortunately our new home is up in the mountains at the end of single lane road. The short story is I had to clear out the POD from the storage facility located an hour away from our new house which entailed renting a U-Haul and paying for movers since this was unexpected and now I was in a time crunch.

Utilities were higher as July includes setup fees for service at the new address and still paying for utilities at the old apartment (we were still primarily living at the old apartment through July).

Fuel was also pretty high in July as there were multiple trips to move stuff between our old apartment and our new home as well as the long distance commute (though some of this was mitigated by the new electric vehicle).

Finally, we still need to work on getting those food expenses down (plenty of room for improvement).

Net Worth

Even with the extra spending our net worth jumped up $15,129 in July to a new total of $372,572. This was mostly fueled by the appraisal of our new house coming in higher than our purchase price and contributions from income. This offset the approximately $8,000 drop in cryptocurrency value.