I recently saw a post on Facebook from a fellow federal employee with a simple question. Should they take a refund of their FERS contribution if they leave government service after 9 years? I wanted to dig into this a little as I am currently sitting at 9 years of government service myself. An important point to remember is that only the amount you contributed will be part of that lump sum refund.

There are several factors to consider when making this decision:

1) What type of FERS are you covered under

2) Number of creditable years of service

3) High three average salary

4) Total amount contributed

FERS, FERS-RAE, FERS-FRAE

Orginially the amount contributed to FERS was the difference between 7% and social security taxes (6.2%). This means that feds who started before January 1, 2013 are only contributing 0.8% of their paycheck toward the FERS pension. The good news is that as long as you maintain federal employment you get to keep this contribution amount (i.e. you can change jobs within government, you just can’t leave federal service).

FERS – Revised Annuity Employee came into being after the great recession as part of the “Middle Class Tax Relief and Job Creation Act of 2012.” In this law congress increased the employee contribution for new employees hired on or after January 1, 2013 from 0.8% to 3.1%.

FERS- Further Revised Annuity Employee was created because felt that federal employees still weren’t paying enough. The “Bipartisan Budget Act of 2013” (one year later) increased contributions for new employees hired on or after January 1, 2014 from 3.1% to 4.4%.

I’m on a fringe case where if I ever want to leave federal service and come back later I will be reinstated at the FERS-FRAE. This is because there is an exception for feds who had 5 years of creditable service before the dates listed above. I started in June of 2009, so I missed the FERS-RAE date by about 6 months, and the FERS date by 1 year and 6 months. Therefore I will do my best to maintain continuous service until I decide I am done with federal employment forever.

Creditable Years of Service

More years of service generally means retirement is closer. The pension payout starts sooner, it’s bigger, and if you withdraw your contributions to reinvest somewhere else they have less time to grow. I’m at that point where it might be a toss up which way to go (9-10 years). This is the one of the factors that contributes to the pension formula.

High Three Average Salary

The current retirement formula still uses the high-3 average for pension calculation. This is second factor that contribues to the pension formula. My high-3 average is about $100,000. This number only includes your adjusted Basic Pay (basic pay + locality), no overtime or special pay included.

Total Amount Contributed to FERS

The total amount contributed is what you will be able to pull out and reinvest. The larger this amount is the larger your principal for investing will be. A little over 9 years of federal service I have contributed a whopping $5,709.50.

Because this is my blog I’ll use myself as the case study.

Age: 31

Retirement Age: 62

Investing Timeline: 31 years

Years of Creditable Service: 9

High-3 Average Salary: $100,000

Total Amount Contributed: $5,709.50

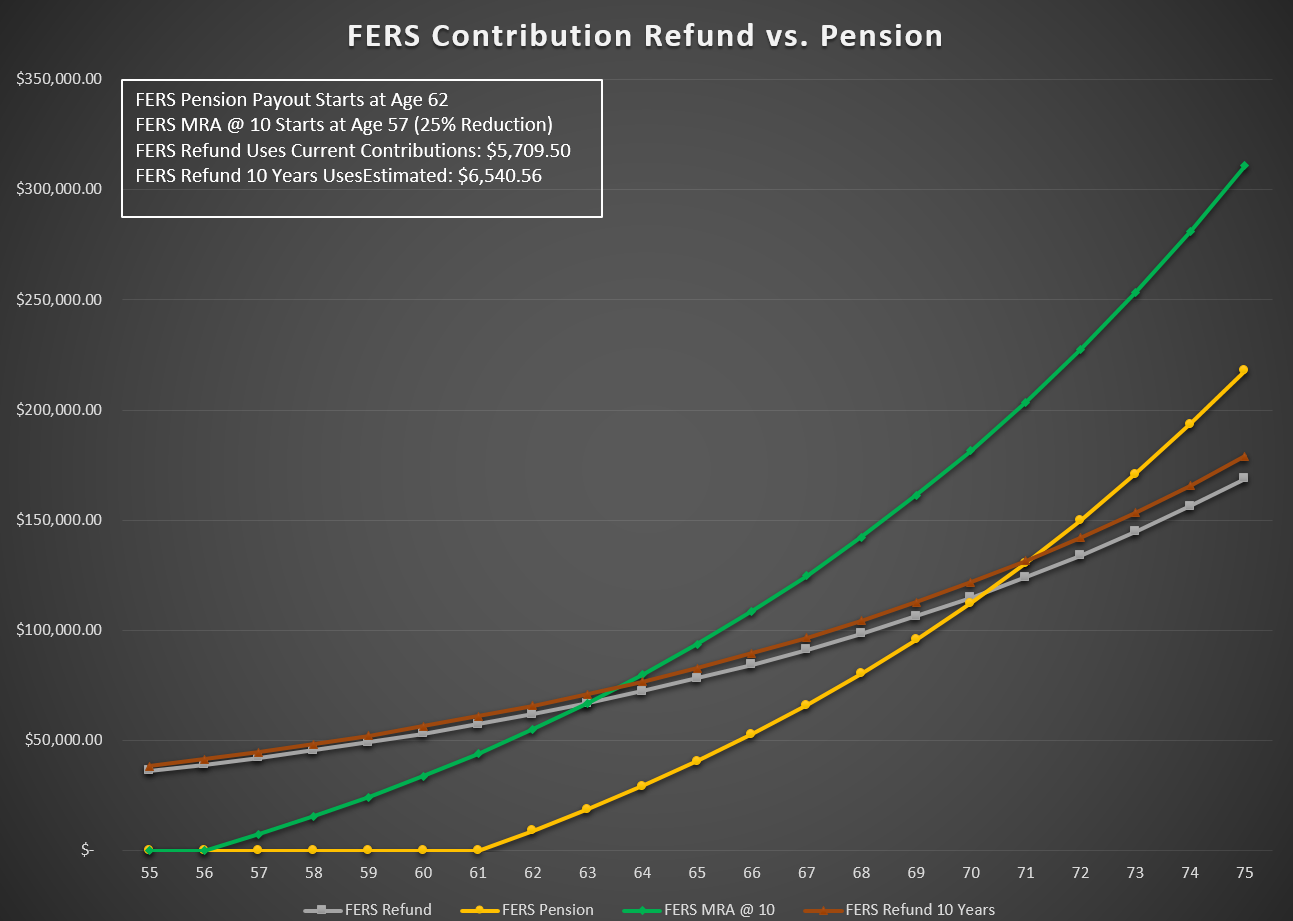

My intuition was to leave my FERS contributions in place when I leave federal service and collect the pension. As you can see in the chart my assumption was right assuming I live at least to 71 years old. I have a second chart that projects this out to 113 where this strategy would effectively double the alternative of pulling out the contributions and investing.

The other question that I have wrestled with in the past is when to start drawing my contributions. Since I don’t plan on working for a full 30 years where I could take my pension penalty free prior to 62 my options are either a) wait until 62 to start collecting or b) start collecting at 57 but have the payout permanently reduced by 25% (5% per year under 62).

The chart above answers that question quite simply as well. I would start collecting the pension sooner and with the same compound interest of 8% the lower age stays ahead and the gap widens each successive year.

I only posted one chart using 8% which I feel is reasonable over the long term. However, I have included an excel sheet here, which has the calculations and you can easily change cell C3 to your preferred interest rate. Using lower rates of return the crossover points come sooner. At 10% my crossover point doesn’t happen until I’m 77 years old, and at 11% the refund stay ahead.

I think 11% may be a bit wishful thinking, and there is the advantage of some diversification in my retirement income.