My first career position out of college was (and still is) a federal government job. When I was hired back in 2009 federal government employees were covered under FERS (Federal Employee Retirement System) as opposed to CSRS (Civil Service Retirement System). The FERS retirement is setup as a stool (or tripod) and it involves three components: a pension, a defined contribution plan, and social security. Today I want to focus on the defined contribution component, the Thrift Savings Plan (TSP).

My first career position out of college was (and still is) a federal government job. When I was hired back in 2009 federal government employees were covered under FERS (Federal Employee Retirement System) as opposed to CSRS (Civil Service Retirement System). The FERS retirement is setup as a stool (or tripod) and it involves three components: a pension, a defined contribution plan, and social security. Today I want to focus on the defined contribution component, the Thrift Savings Plan (TSP).

The TSP is defined in 5 USC 84 and falls under the same section of the Internal Revenue Code as private company 401 plans. Enough of all the rambling legalese we want to dive into the TSP from a practical standpoint: How to I contribute, what does my agency put in, how should I invest it, when can I take it, etc.

Traditional vs. Roth

We’ll start with the two types of TSP available. As with other 401(k) plans there is a traditional TSP and Roth TSP. The main difference being how the money is contributed and how the money grows. The traditional TSP is funded using pre-tax dollars while the Roth uses after tax dollars. Therefore in a typical scenario the distributions from the traditional TSP will be taxed and the Roth distributions will be untaxed.

I am writing from my own personal experience so I will focus on the traditional TSP as that is what I started with and continue to invest in today. Others may choose a Roth TSP, but in the FIRE community one of the things we like to take advantage of it tax optimization and a traditional TSP allows you to reduce your taxable income by up to $18,000 (in 2017). Since I have only started pursuing FIRE recently I haven’t taken full advantage of some of the things I will be writing about. Last year was the first year that I maxed out my TSP contributions.

- What is the TSP?

- It is a defined contribution benefit plan, 401(k)

- What is the elective deferral limit?

- The maximum employee contribution (does not include matching from employer)

- What is the Maximum Contribution Limit?

- The combined total of your contributions, agency automatic contribution, and agency matching

- Cannot exceed your compensation

Contribution Limits

|

Age 49 and younger |

Age 50 and Older |

|

|

Elective Deferral Limit (2017) |

$18,000 |

$24,000 |

|

Maximum Contribution Limit* (2017) |

$54,000 |

$60,000 |

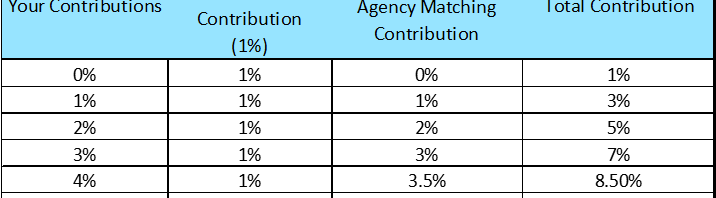

Automatic enrollment in the TSP change in 2010. Prior to August 1, 2010 no contributions from the employee were automatically deducted, the only contributions to your TSP account would have been from the agency automatic 1%. The government realized that employees weren’t taking advantage of the contributions to the TSP and started automatically enrolling new employees in the TSP with employee contributions of 3%. Therefore a new hire will now be getting 7% (1% agency automatic, 3% employee contributions, and 3% agency matching dollar for dollar) for their income deposited into their TSP account.

At Least Get The Match

At the bare minimum any new (or current) employee should at least increase their TSP contributions to 5% to take full advantage of the agency matching (also known as free money). This would bring the total contributions to 10% (the last 2% of agency matching is only 50 cents per dollar (1:2)). I’ll have another article in this series on how to move from just capturing the free money to maxing out the TSP.

Now that you have some money in your TSP, what do you do with it? Invest it!