Part I setup a lot of backstory and now I want to focus on how we paid off $79,000 (including $8,398.76 in interest) of student loan debt in one and a half years. We were in a pretty unique situation so it isn’t applicable to everyone, but when you take into account the additional expenses we had I think it evens out.

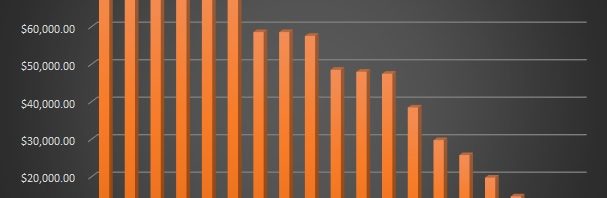

Student Loan Payment Progress

As you can see made far exceeded the minimum payments on these loans. We decided early on that we wanted to push through the student loans as fast as possible. It didn’t make sense to do the loan forgiveness as we didn’t want to be paying student loans for 10 years. Additionally this why our highest interest debt at 6.21% and 5.84%.

Beginning to Payoff

While we were paying off these loans Lady Kit was in an internship working 80 plus hours per week for about $38,000 a year. This is pretty low for her profession, but much like medical doctors, internships for veterinarians are low wage as well. Big picture though, this was like a raise of $88,000 a year since she earned $0 while in school and we had to pay $50,000 for tuition.

Her internship was located about 5 hours from our house so it extended our separation for another year. Knowing this it became the perfect time for me to take a temporary assignment in Washington, D.C. since we weren’t going to be living together that year anyway. This provided me with a great professional experience, and additional income as my work gave me a per diem (to cover food and lodging) and I was able to live frugally enough that I was able to save a significant a chunk and put it towards the student loans.

Since we were both busy with work we also didn’t have a lot of luxury expenses, but still managed to spend $60,000 not including housing (fuel, utilities for 3 housing locations, food, amazon, pets, clothing, travel). Our housing expense totaled about $5,700 a month (our mortgage, her apartment, and my apartment). We left our house vacant while we were away, as I didn’t want to move our stuff out, and I didn’t want strangers using our stuff, and I assumed we would be moving back in. However, we ended up selling the house 3 months after my assignment in Washington, D.C. ended.

Here you can see the payments we made and how the loan balance dropped over a year and a half. We started off with some big payments with money we had saved. The first payment was to reduce the amount of interest that got capitalized into the loan. At the end significantly depleted our reserves so we could meet my goal of paying off all the student loans by the month I returned to California. We did actually pay them off in September 2017, but the payment didn’t post to our bank until October 2017.

All our extra income to purge those loans

So, how were we able to make all those massive payments? The biggest key was prioritization. We had a goal and stuck to it. You can see at the end of 2016 and the beginning of 2017 the payments were smaller. During this time we were trying to cash flow 2 rents and mortgage while waiting for me to be reimbursed by my employer.

Lady Kit was the much more frugal one as she already felt her rent was too expensive (plus she didn’t have time to spend money since she was always working).

Taking Advantage of Employment Benefits and Living Like a Bachelor

I was in a metropolitan area. I drove my car (full of stuff) from California to Virginia and expected to use it quite a bit since I always had in Southern California. However, during the entire year I was there I only filled the gas tank 3 times (and one of those was topping off the morning I began my drive back to California). The D.C. area has good mass transit, I lived 1 mile from work, and the grocery store was across the street so I got most places by metro, foot, or bike (MMM would be happy with that pedal power).

As I mentioned I drove across the country in my 4-door sedan full of stuff. The apartment I stayed in was unfurnished so I had to bring my own furniture (but I didn’t). Once I arrived I furnished my apartment through amazing at the cost of about $400. For the entire year I was there my furniture included:

- A folding table (now part of our camping gear)

- A self-inflatable air mattress (now available for guests when we buy a new house)

- A desk chair (sold at cost to a new resident a couple days before I left)

- A cardboard box as a night stand (recycled)

I also had to get smaller things like sheets, shower curtain, a couple of dishes, etc. I made sure everything I got was something I could fit in my car for the drive back and would be something useful back in California.

Now that we don’t have any student loan debt we have much less stress about financial planning and puts us in a better situation for house hunting (our current task).